If we look at a typical multifamily investment project acquired through syndication, where a sponsor puts together a deal and raises funds for the deal from investors, there’s going to be an opportunity for those investors to own a piece of the project and participate in the cash flow, capital gains, and all the reasons we invest in real estate. There are a few steps to investing passively in these deals. Investing passively in syndications can be a true turn key deal, where you’re not doing any of the work. You’re not making design decisions or finding the property or handling the asset management, etc. It’s truly turn key. It’s mailbox money and you are getting all the benefits of being a partner in the deal. You will get a depreciation break on your tax return and this can result in something almost kind of magical for people who haven’t heard of it before. So while the project is generating cash flow, you’re getting distributions every quarter. Then at the end of the year, you are also getting a paper loss, meaning that it didn’t happen in real life, but it is a negative dollar amount on what is called a K1, passed through to you. That is a fantastic benefit of the tax code that we can take advantage of as real estate investors, to get cash flow and get a paper loss. If you are a high-income earner, it’s a very attractive option. In fact, many investors are looking to these investments primarily for depreciation and the K1 loss at the end of the year, so it is a huge benefit.

So what are the steps to investing passively in a project? First of all, this whole business is relationship based. You will need to find a sponsor who has experience and who you know, like, and trust. I would not advocate doing business with someone you don’t like. Obviously if you don’t trust them, you’re not going to do business with them. You want to get networked, and you want to get some kind of deal flow. You need to have deals put in front of you that you can evaluate. You need to have some fundamental knowledge of how to evaluate deals.

Some things to look for and understand is in a passive deal are whether a preferred return is provided, what is the expense ratio on the deal? What is the business plan and how will the sponsors execute that business plan? How much capital improvement is budgeted? What is the expected rent growth? These are all questions to review with the sponsor. Understanding these questions and your own risk tolerance will allow you to evaluate whether or not a deal is within your comfort zone. So you will need to find some sponsors and get in some deal flow that you can start evaluating. That is the first step.

The second step: obviously you need capital. Typical minimum investment on a multifamily project is $50,000. More experienced sponsors that have a large database or group of investors may be as high as $100k, $200k, or $300k to get into a project. But typically, in the multifamily syndication space, you’re seeing investment minimums of $50 – $100k. If you don’t have that capital to invest, then passive investing in multifamily may not be for you at this time. But there are pools of capital that people don’t realize is available to them. Somebody who is working a 9-5 at a corporate job, between their family obligations and monthly expenses, might be spending all their money and putting a little aside for savings. But they may also have a $500,000 IRA or 401k. This is capital that you can use in a multifamily investment. There are ways to take that capital in the IRA or 401k and self-direct it into multifamily investments. They can’t be your own deals. It needs to be an arms-length transaction. It needs to be someone else’s deal. But that is a huge pool of capital that many people don’t realize can be tapped for multifamily investing . It is a lot of money in the American retirement system, and you as a passive investor, that might be a capital source that you can go use.

Other capital sources that we have seen, and that I started out early in my investing career to get some investable capital, selling cars that cost too much; capital in single family residences. It is very common to take equity that you’ve built over the years in some single-family residences. We have countless investors that do that. They say, hey, I have these houses over here but I’m ready to move up to the multifamily space and these houses have some equity. Maybe I’m going to refinance out that equity and put it into a passive investment deal or sell the house. But there are pockets of equity. We certainly wouldn’t advocate going into debt to finance an investment. If you’re going to invest passively in a multifamily project, you need that to be cash. So is it cash in the bank, 401K, IRA, or liquidate some other assets, like real estate. But it needs to be cash. Don’t put debt into a project. That is like stacking two ladders on top of each other. Never a good idea!

Once you understand how to look at deals and if it is something you want to invest in and you found some sponsors whom you know, like, and trust, and you are evaluating deal flow, then you are going to go through the process of investing. It is fairly simple. You will see a deal come out; there are some documents to sign, a private placement memorandum, a subscription agreement, investor questionnaire, and then you’re going to wire funds into the project typically 2-3 weeks before the closing, and then the project closes. You will get monthly updates after that, and quarterly cash flow checks start coming in.

While the education is important (and that is a requisite at the front end; you do need to get educated) once you got some deal flow, the actual process of investing is simply sign the documents, wire the funds, check your email every month. If you want to be more hands on and tour the property or ask the sponsor questions, certainly that is on the table, but beyond the requirements as a passive investor. If you have a W2 job you like or maybe you’re already retired and don’t want to mess with evicting tenants, passive multifamily investing is a great way to still be a partner on a project and benefit from the sponsors work. Perhaps you are an active real estate investor but are worried about how to take your investment activity to another level, passive investing is a great way to scale.

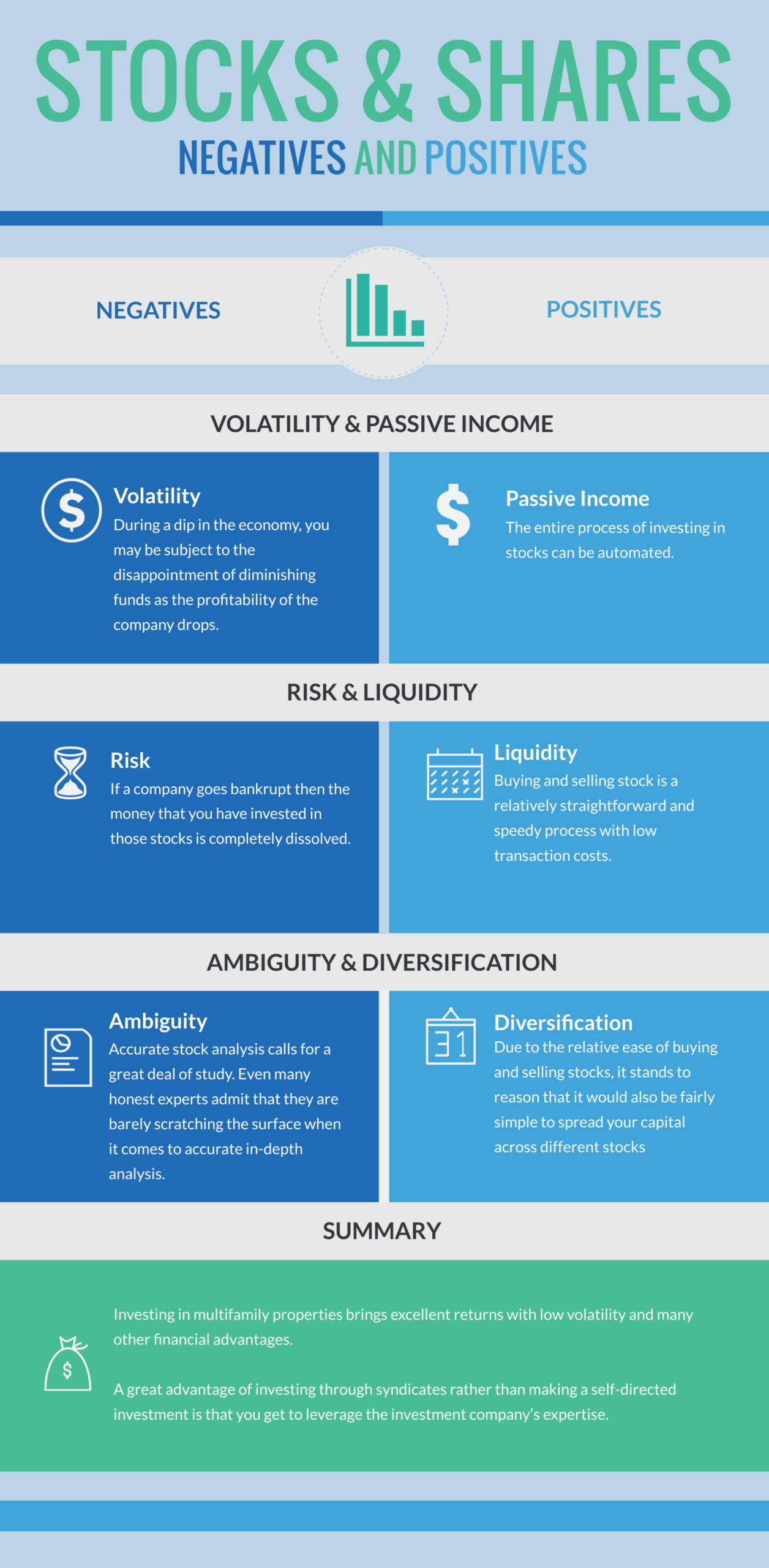

The return projections on a typical multifamily investment project, from a very high-level perspective, sponsors will typically target a 6-8% return cash on cash every year. So if you invest $100k in a project, that sponsor is going to want to deliver 6-8k per year back to you. That beats lots of investment instruments, like CDs money markets, and other fixed income instruments like that. It may even beat the stock market when you consider the S&P 500 has an average annual return of 6-7% over long periods of time. So, you’re getting 6-8%, sometimes even 10% cashflow on your money every year. Then the sponsor is looking to get an equity multiple for you. This is generally of close to 2 times over a 5-7 year holding period. So, the sponsor is looking to double your money in 5-7 years. This is a typical underwriting approach and what sponsors are looking for. Now, if a sponsor can get in and out of a deal in two years, and they didn’t double your money, but they give you a 30%-40% cash on cash return, you would take that, right? So, that can be the case sometimes where a sponsor underwrites a five-year hold, but gets it done in two years. As long as that annualized return is really great, then investors are going to be happy. And, as we talked about before, at the end of the year, you’re likely getting a K1 with a paper loss because of the accelerated depreciation!

So, that’s the overview of passive investing. You need to

· get educated

· find sponsors you know, like, and trust

· start looking at deal flow

When the time comes:

· sign documents

· wire funds

Most sponsors run a first come first serve operation because, let’s say you’re raising $5 million, and you have 35 investors on a project, and you have 200 potential investors. It is too difficult for a sponsor to go out there and manage expectations individually. It’s much more efficient for a sponsor to come out with a project, announce it to their investors and have it open for funding until it’s not. So, the key for the passive investor is to get educated so that you’re able to strike quickly when the time comes. Because, once it’s full, that’s it; you’re done! People that have been passive investors in the past know to ask questions of the sponsors up front and get to know the sponsor up front, get educated so that they can very quickly evaluate a deal, and strike quickly when the window opens because it is typically not open for very long with an experienced sponsor.

So that is an overview of passive investing and one of the best ways to participate in multifamily investments without having to do any of the work. Download the free white paper to learn more about passive investments in multifamily at SASTexasCapital.com.